Syria began 2011 with its economy in relatively good health. A year later, it looks very different: everything is getting worse and will continue to do so until the uprising ends. As I have said before, the state of the economy will be a major factor in determining how long the Assad regime survives.

The regime's finances, like much else in Syria, are far from transparent but a couple of articles cited on the Syria Comment blog show a grim picture.

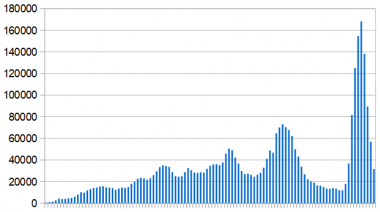

In the budget for 2012, approved last month, revenue is dramatically down and spending is up, leaving a gap of SYP 529 billion ($9.6 billion) on a budget of SYP 1,326 billion ($24 billion). In other words, only 60% of what the government spends will be covered by revenue. This deficit is likely to be at least 18% of GDP – an alarmingly high level.

The situation has been mitigated to some extent by a drop in imports (partly a result of declining investment) which in turn has helped to save the currency from falling precipitously. The Syrian pound is down by a relatively modest amount (from 46 to the US dollar a year ago, to 53 now). The authorities have also called for a 25% cut in non-salary spending by state institutions.

For normal countries, borrowing to cover the deficit would be an obvious course but Syria's options in that regard are extremely limited. It may be getting some help from Iran, Iraq and Venezuela but how deeply any of them will be prepared to dig into their pockets, and for how long, is an open question.

Another solution, proposed by Dr Elias Najmeh at Damascus university, is to draw on compulsory loans from Syrian businesses. There is some logic in this, since the successful ones have profited from the regime's protection (and its corruption) in better times. However, it does smack of desperation and politically it could be very dangerous indeed, since it would hit many of the regime's core supporters. Who, in their right mind, would lend money to Assad now on a promise of getting it back in three to five years?

Posted by Brian Whitaker, 2 January 2012

RSS Feed

RSS Feed